In today’s Finshots, we talk about the debate on regulating the beedi industry

The Story

Did you know that India’s beedi industry is actually classified as a cottage industry?

You know, the kind where most people employed work from home or from small units. And where technology isn’t that prevalent in the manufacturing process.

This means beedi makers have escaped the regulatory net for decades. They get all sorts of tax exemptions. For instance, those who manufacture under 2 million beedis a year didn’t have to pay tax. And while the taxes on beedis are as low as 22% of their MRP, cigarettes have an average tax of 52%.

But the All India Institute of Medical Sciences (AIIMS) Jodhpur and the International Union Against Tuberculosis and Lung Disease think this privilege should be stripped away. On Friday, they published a report recommending that we tax and regulate these sticks just like cigarettes and other tobacco products.

Now before we get into the why and how, let’s go back in time. To the evolution of the beedi industry and understand how beedies got its cottage industry status in the first place.

It all apparently began sometime in the late 17th century. Tobacco was cultivated in southern Gujarat and men in the region spent their evenings chatting away while they passed a hookah around. It was a leisurely activity but they weren’t big fans of the hookah’s portability. Slowly the hookah gave way to the cheaper and more mobile alternative ― the chillum or the pipe. But even this was disrupted when workers began to roll up leftover tobacco in the leaves of the astra tree of the region. The ease at which they could be done meant that more and more people picked up the humble beedi.

Initially, the Gujaratis only rolled beedis for home consumption. But as the demand picked up, rolling beedis became a home-based business. And in the 1900s, as Gujaratis migrated to Bombay in search of better opportunities, they took their beedi business to the port city too. But it was when the railways expanded across the length and breadth of the country that beedis became widespread. The Gujarati businessmen realized that it was now quite cost-effective to roll beedis back at home and transport them to new markets.

Finally, there was the Swadeshi movement which became a great catalyst. In the fight against the British, Indian leaders encouraged people to ditch foreign cigarettes for homemade beedis. The rich, the poor, everyone smoked it. And since then, there has been no looking back for the industry.

But because it was primarily a home-grown affair with small units that also employed millions of workers, the government classified it as a cottage industry. And with that came all the benefits we mentioned at the start of the story.

It also meant that the industry was quite unorganized. In fact, 80% of the beedis that are manufactured don’t come under any sort of regulation. That means, even though tobacco products are supposed to contain pictorial warnings and other disclaimers, most beedi packets don’t comply with these standards.

What do you think happens as a result of this?

Well, combine the lower taxes and lax regulations, and beedis turn out cheaper and more easily accessible to people. And that makes them twice as popular as cigarettes too — while 4% of Indian adults smoke cigarettes, 8% of the population are beedi smokers.

Now here’s the thing. We all know that tobacco is harmful. But beedis are apparently much worse than regular cigarettes. Some research found that oral cancer was 40% more prevalent in beedi smokers compared to those who used cigarettes. Also, smoke from a beedi has 3–5 times more nicotine than a cigarette.

And we lose around ₹80,000 crores a year in dealing with poor health and deaths from just beedi smoking. Not all tobacco. Just beedis.

Now one way to tackle this is by increasing the taxes, of course. Because higher taxes means that beedis will get more expensive and people will naturally reduce smoking, right? And the report by AIIMS and The Union says that tacking on a tax of just 5% will lead to a drop in consumption by 1.70%. And that means we get many more years of healthy lives and fewer expenses on hospital treatments.

For the government, it could be a nice boost to revenue collection as well.

So yeah, now you can see why it makes sense to remove the cottage industry tag and begin to regulate the beedi makers more effectively.

But it’s not going to be easy. Beedi workers already earn peanuts. Far lower than people in other manufacturing jobs. And if increased regulations cause a dip in the sales of beedis, it could have a big impact on the lives of over 8 million people who’re employed directly or indirectly in the industry. And it’s not going to be easy to find them employment elsewhere with their skillsets too.

So, what will the government do? It’s anybody’s guess.

Until then...

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

Term life insurance prices are rising!

A prominent insurer is looking to increase their term insurance rates in the next few weeks.

For some context: when you buy a term life product, you pay a small fee every year to protect your downside. And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones.

The best part? When you buy early, you can lock in your premiums to ensure they're not affected by any future rate hikes.

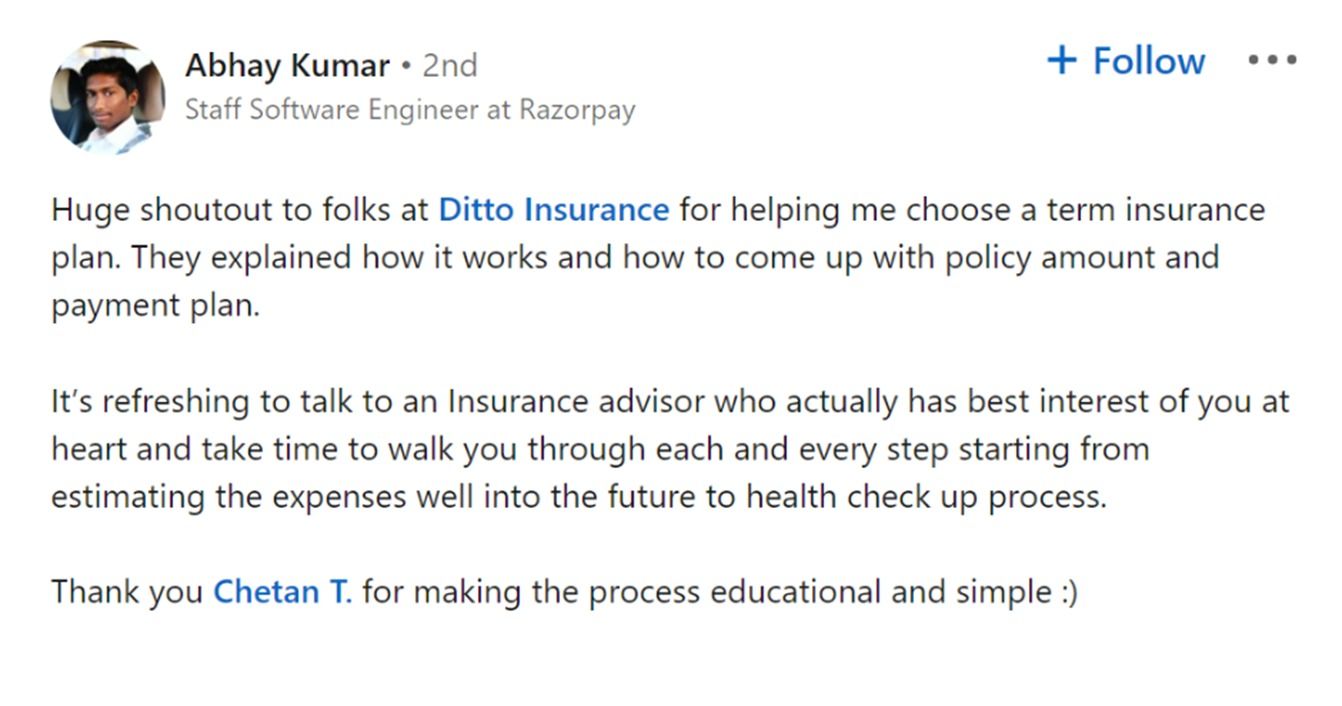

So, if you've been thinking of buying a term plan, now might be the best time to act on it. And to help you in the process, you can rely on our advisory team at Ditto.

Head to our website by clicking on the link here

Click on “Book a FREE call”

Select Term Insurance

Choose the date & time as per your convenience and RELAX!